Bank Sustainably with OCBC’s Sustainability Hub

With emerging climate and sustainability risks, it is important for retail investors to know the ESG ratings of companies they invest in. The principle behind this is that companies that do well in ESG are better positioned for long-term success.

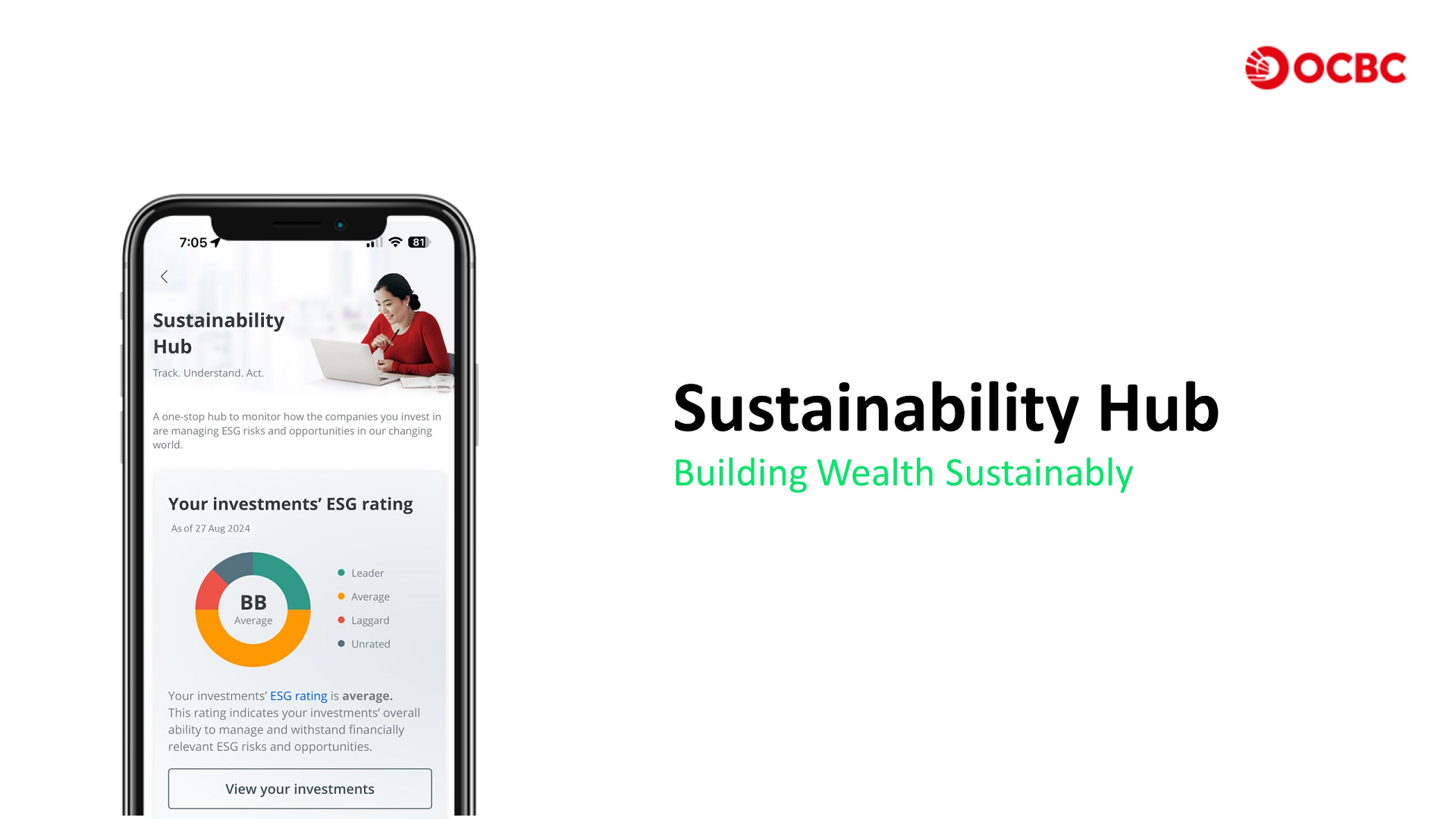

To address this, OCBC developed the Sustainability Hub. Available via the OCBC Digital app, it is the first innovation in the region that provides retail investors with personal ESG ratings based on their investment holdings, and sustainability-related articles and facts.

Retail investors can visualise their exposure and better understand how resilient their overall portfolio is against emerging risks. The Sustainability Hub also curates top ESG picks that may strengthen one’s portfolio.

Find out more here.

View your investments’ ESG rating and stay updated with sustainability articles and facts via OCBC’s Sustainability Hub.

Helping SMEs Understand Their Environmental Impact

OCBC has developed bespoke solutions addressing specific needs of SMEs. An example is the SME Energy Assessment (SMEEA) tool, created in collaboration with the Building and Construction Authority of Singapore.This online self-assessment tool is free-to-use for SMEs and impactful, providing SMEs a quick assessment to predict and improve their company’s energy consumption.

Through the SMEEA tool, SME clients can better understand the impacts of their energy use and applicable green building technologies, so as to implement optimisation strategies.

SMEEA fills a market gap, giving SMEs access to credible green building analysis and certification for spaces and buildings which mass market Green Building certification schemes do not cater toward.

Find out more here.

At OCBC, we support SMEs across all sectors to do well, by doing good – today and together.

Be it decarbonisation efforts or ESG management, OCBC has a host of partners who are prepared to assist clients in their sustainability journey.

Partnering Clients for a Credible Net Zero Transition

With the ambition to be Asia’s leading financial services partner for a sustainable future, OCBC actively embeds sustainability into the client engagement process, advising clients on their decarbonisation pathways.Through transition advisory and innovative financing, OCBC offers solutions designed to support clients to achieve their climate aspirations. An example is the OCBC 1.5°C loan offered to CapitaLand Ascott Trust and City Developments Limited, incentivising clients to set and achieve ambitious decarbonisation goals aligned with a 1.5°C trajectory.

The OCBC 1.5° loan is a market-first solution that reflects OCBC’s commitment to support customers on their net zero journeys. As at 30 June 2024, OCBC’s sustainable financing portfolio reached S$63.3 billion.

Find out more here.

The OCBC 1.5°C loan reflects OCBC’s commitment to support customers’ net zero journeys with transition advisory and innovative financing solutions.

OCBC is committed to partnering with clients to help them achieve their climate aspirations – for now and beyond.

Supporting SMEs in Their Climate Transition

SMEs play a pivotal role in the global net zero transition. OCBC’s SME Sustainable Finance Framework makes it simpler and less costly for SMEs to access sustainable financing to achieve their sustainability plans. OCBC has extended sustainable financing solutions to over 1,200 SMEs since the launch of this framework.With the growing global commitment to reduce emissions, many SMEs now aspire to embark on their sustainability journey to future-proof their businesses. However, the task of calculating emissions and reporting can be daunting. Hence, OCBC is committed to continue simplifying sustainable finance for SMEs, while developing an ecosystem of enabling partners to support SME clients across diverse industries.

Find out more here.

OCBC offered Ghim Li Group a S$16 million sustainability-linked loan, using verified emissions data from the AI-powered ESGpedia platform by STACS.